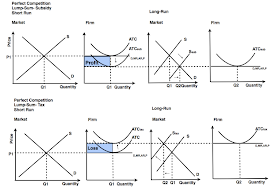

Subsidy - Humor

Per-Unit Subsidy - a sum given to the producer for each unit of good that is produced.

Per-Unit Tax - a tax imposed on the producer for each unit of good that is produced.

Lets do per unit tax first.

So, Short-run is on the left and Long-run is on the right.

Lets start with the short-run. The market graph is drawn showing supply and demand in equilibrium. Firms look at per-unit taxes as if they are extra costs added to the firms variable costs. Increases in variable costs will shift the marginal cost curve left. Variable cost increases will effect the ATC or Average total costs curve, the AVC and the MC curves.

- A per-unit tax will shift the ATC upward, in the short-run the firm will have a loss due to the tax. Remember - that in the short run other firms cannot enter the market. The firms marginal cost curve is effected and shifts left with an increase in variable costs. (wages increase, production falls, tax increase, all cause the MC curve to shift left). Quantity will decrease.

- In the long-run firms exit this industry. As more producing firms exit the market, supply decreases, pushing up the market price and decreasing the quantity produced. In the long run the the price will increase to the point that the firm is only making normal profit/zero economic profit.

So, Short-run is on the left and Long-run is on the right.

Lets start with the short-run. The market graph is drawn showing supply and demand in equilibrium. Firms look at per-unit subsidies as if they are monies decreasing the firms variable costs. Decreases in variable costs will shift the marginal costs curve right. (decreasing wages, increasing worker productivity, and subsidies) Variable costs decreasing will effect the ATC or Average total costs curve, the AVC and the MC curves.

- A per-unit subsidy will shift the ATC downward, in the short-run the firm will earn positive (super/abnormal) economic profits due to the subsidy. Remember - that in the short run other firms cannot enter the market. The MC curve will shift right. Quantity will increase.

- In the long-run firms are attracted to this industry's abnormal profits and will enter the market. As more producing firms enter the market, supply increases, pushing down the market price and increasing the quantity produced. In the long run the the price will decrease to the point that the firm is only making normal profit/zero economic profit.