AD/AS Recession FRQ Review

Developing a workbook for AP - Thoughts are appreciated (wcwaugh@aol.com)

Over the last 22 AP Macro Exams the Recession Graph of the economy has been requested 12 times. It is expected that you not only be able to graph an economy in recession but you must be able to recognise an economy in recession by the AP's language (phraseology)

2003B - Assume that the country's economy is operating below full-employment.

2003 - Assume the economy is in a severe recession with no inflation.

2004 - Assume the economy is operating at less than full-employment

2006B - Assume the economy is operating at less than full-employment

2006 - Assume the economy is currently at equilibrium below full-employment

2007 - The economy is currently in recession but recovering

2009B - The unemployment rate is greater than the natural rate of unemployment

2010B - Assume the country's economy is in short-run equilibrium with an output level less than the full employment output level.

2011 - Assume the economy is currently in recession in a short-run equilibrium.

2012 - Assume the country is in recession

2014 - Assume the economy is operating below the full-employment level of real gross domestic product with a balanced budget

2015 - Suppose the economy is operating below full employment

2016 - Assume the economy is currently in a short-run equilibrium with the actual rate above the natural rate of unemployment.

So, if we deconstruct this a bit, we see a few phrases that keep repeating.

- Recession (easy)

- less than full employment or below full employment (full employment is the NRU)

- unemployment rate is greater than (above) the natural rate of unemployment (NRU)

So, if you see any of these phrases, its a tip that a recession curve will be asked to be drawn.

So, how would this look.

1. Assume the economy is in recession.

(a) Draw a CLG (clearly labelled graph) of the AD/AS curve of the economy below full employment.

List all of these, every time to check your own thinking. (ROUPY)

RGDP - Decreasing

Output - Decreasing

Unemployment - Increasing (above the natural rate of unemployment) (Understand this!!!!)

Price Level - Decreasing at PL2

Y = Income - Decreasing at Y2

2. Assume the economy is operating below the full-employment level.

(a) Draw a CLG (clearly labelled graph) of the AD/AS curve of the economy below the full employment level and (ROUPY).

(b)The government decides to lower individual income tax rates to achieve full employment.

(c) Explain (WHY) how the government's decision to lower income tax rates will affect the AD & SRAS curve.

(d) List using (ROUPY) what happens in the economy when the government lowers the tax rates.

(a)

RGDP - Decreasing

Output - Decreasing

Unemployment - Increasing

Price Level - Decreasing to PL2

Y = Income - Decreasing to Y2

(b) The government lowers individual tax rates (this is a determinate of AD)

Be careful not to get this confused with a lowering of business tax rates as that would be a determinate of AS)

(c) The lowering of individual income tax rates (expansionary policy) will increase the levels of disposable incomes in the economy and lead to more (C) consumption and (I) investment and therefore AD will increase. The SRAS curve will not be affected.

(d)

RGDP - Increases as (C) & (I) increases

Output - Increases as more disposable income in the economy stimulate AD.

Unemployment - Decreases as more people are put back to work as output increases.

Price Level - Increases (Businesses raise prices as demand increases)

Y = Increasing Incomes due to demand for labor because of rising demand for goods

Understand the flow of these questions.

The economy is at a point (equilibrium, recession, inflation)

You can be asked to graph (AD/AS) the above.

Then the government, or the FED does something, or something happens in the economy (oil prices fall, Consumer confidence rises, government spending increases, the FED buys bonds)

You are asked to graph (AD/AS) the affects of the above and or explain.

The last section pertaining to the AD/AS curve is if the government does nothing.

The AP exam has asked this 5 times over the last 22 FRQ exams.

2004 - No policy action is taken

2006B - no policy action is taken and wages and prices are flexible

2009B - Government decides to take no policy action

2011B - In the absence of any fiscal (government) or monetary (FED) policy

2011 - Now assume the government and the Federal reserve take no policy action

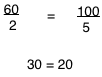

Equilibrium

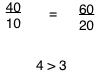

Equilibrium to Recession

Recession in the Long-Run (No Policy (Gov't/FED) Actions)