2019 AP Macro FRQ #1

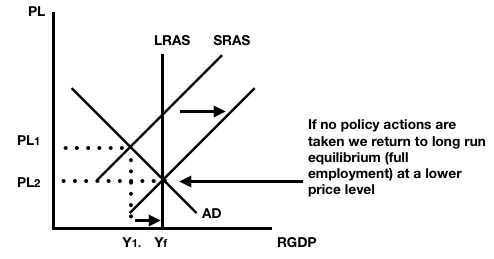

Understand that "no policy action" implies a classical view.

(b)(i) If no policy actions are taken then workers will accept lower wages, lower wages will shift the SRAS curve rightward, as wages fall business owners will lower the prices of goods and services, lower prices means people buy more stuff and output increases back to the full employment level.

The classical view implies that the economy has flexible prices and wages

and therefore will always return back to LR equilibrium just at a lower price level.

(b)(ii)

If the MPC is .8 then the MPS is .2 as they together always equal 1.

To find the government spending multiplier we can use the formula

1/MPS or 1/1-MPC

I'm like a child and always use the simplest of 1/MPS or 1/.2 = 5

Our spending Multiplier is 5

This implies that anything spent by the Government will be multiplied by 5

If we are in a recession at $500b and full employment is $540b

then we need $40b of GDP increase to close the recessionary gap.

40b/5 = 8b

If the government spends 8b and we multiply that by the GS Multiplier (5)

we get an increase in GDP of 40b.

(c)(i) Minimum change in spending increase of 8b.

Understand that the short understanding is to recognize that the

Government Taxing Multiplier is always 1 less

than the Government Spending Multiplier

So, our taxing multiplier is going to be 4

The government would have to reduce taxes by

40b/4 = 10b

to get the aggregate demand curve to full employment.

Reducing taxes is expansionary and we are in a recession so reduce taxes.

(c)(ii) Minimum change by decreasing taxes of 10b.

As the Canadian Central Bank (FED) buys bonds the MS will increase, driving down the

Nominal Interest Rates, lower interest rates stimulate investment, increasing aggregate demand

getting us back to full employment.

Recognize that lower interest rates inside the country

attracts investors that want to take out loans from banks.

Charge an interest rate

Understand that capital flows of currency from one country to another

are about putting money into banks to get a higher return.

As the rate of interest in Canada falls, Canadian citizens look to put

their money into Mexican banks that pay a relatively higher interest rate.

Pay an interest rate.

Canadians will dump their monies into the FOREX increasing the supply of

Canadian dollars in the FOREX, therefore the value of the Canadian dollar decreases

relatively to the Mexican Peso