Federal Reserve - Central Bank - Monetary Policy

Past AP Exam (Released) Questions

Multiple Choice Review

(A) Keep part of their demand deposits as reserves

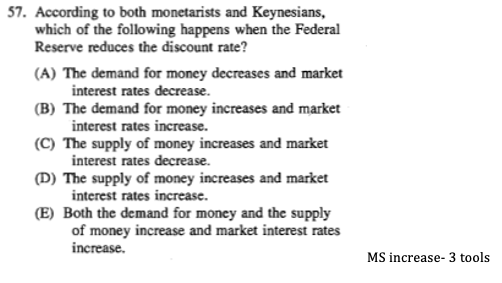

(E) The Discount Rate - The rate of Interest that the FED charges banks

when they borrow from the FED

(FED2Bank Loans)

(D) Business purchase more factories & equip

RRR decreases-MS increases-Nominal Interest rate decreases-Investment increase

Investment = More loans taken out to create capital goods - factories, equipment, tools etc

(E) Banks less able to extend credit

If people's DM increases then they want more money in their poskets and less money in the banks - If the banks have less money they have less ability to extend loans

also if there is less money in the banks the NIR will increase and less people will

take out loans for investment purposes.

(Below full employment level of output) = Recession

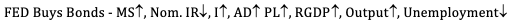

(D) open market purchases of bonds

(D) MS increases and market (nominal) Interest Rate decreases)

(B) bank charge one another for short-term loans

FED Funds Rate = (Bank2Bank Loans)

(E) Fed buys gov't bonds

As the Fed Buys Bonds the MS increases and the Nominal Interest rate decreases

Lower nominal rates = lower rates that banks can charge one another

therefore lower Federal Funds rates

If you only have the categories of

Required Reserves & Excess Reserves

Then Req. Res. & Exc. Res. must = Checkable Deposits

$45 must be in Required Reserves & $45 is 15% of $300

(B) Increase by $200 - Increase by $30

$200 is deposited in Checkable deposits

the RR is 15%

15% of the $200 goes into the Req. Res. = $30

the rest ($170) flows into Exc Res.

What is in Excess Reserves can be loaned out

(C) $3,000

Anytime the College Board gives you (Total Reserves or Reserves)

you must figure out the required and the excess

they are trying to trick you - the jerks!

(D) $9,000

(D) $500

RRR = 20%

Money Multiplier = 1/RRR = 5

Banks Loan out money from Excess Reserves increases the Money Supply

$100 in excess reserves x 5 = $500 increase in the Money Supply

(B) $900

$100 in Check Dep.

RRR = 10% therefore $10 in Req Res.

$90 flows into Excess Res.

Banks loan out all of their Exc Res.

Money Multiplier = 1/RRR = 1/.1 = 10

$90 x 10 = MS increases by $900

(B) less than $5 million

** Notice in the question (A $1 million increase in Reserves)

If the full $1million was in excess reserves

and it all was loaned out.

The Money Multiplier = 1/RRR = 1/.2 = 5

$1million x 5 = 5 million increase in money supply

but

The problem said: banks voluntarily keep some excess reserves.

If banks loan out less than the $1 million in exc. res. then the money supply can't increase by the full $5 million

(C) $2,000 billion

** Tricky tricky question

Recognize that when the FED buys bonds the MS increases by $400b immediately

Then when citizens deposit that $400b in the banks the money supply

increases again when banks loan out money

Exc Res. = $320 x 5 = $1,600 increase in the MS

Therefore $1,600 Bank increased MS

+ $400 FED increased MS

= $2,000 total increase in MS

(C) $900

(E) Decrease of $5 million

Selling Bonds is Contrationary - MS will decrease

RRR = 20% = Money Multiplier = 1/.2 = 5

$1 million sold bonds = $1m x 5 = $5 million decrease in MS