2009 Microeconomics FRQ #2

Watch me answer it here

(A) Calculate the producer surplus before the tax.

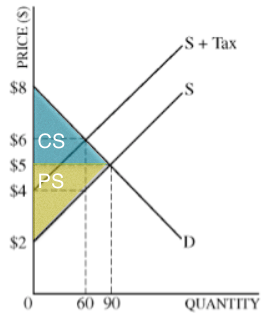

You must know what sections of the graph (before the tax) are consumer or producer surplus.

Producer surplus is a triangle shaped area.

The formula for a triangle is

Area = 1/2 base x height

base = (0 to 90) = 90

height = (5 to 2) = 3

3 x 90 = 270/2 = $135

or

3 x 90 x .5 = $135 (Producer Surplus)

Lets calculate the consumer surplus for shits and giggles.

Area = 1/2 base x height

base = (0 to 90) = 90

height = (5 to 8) = 3

3 x 90 = 270/2 = $135

or

3 x 90 x .5 = $135 (Consumer Surplus)

(B) Now assume a per-unit tax of $2 is imposed.

(i) Calculate the amount of tax revenue. (Government Revenue is tax revenue)

1st, you must understand that the vertical distance between the two supply curves is the amount of the tax per-unit.

So, $2 is the tax per-unit. You were either told this like this question did or you could look at the numbers on the vertical axis. The supply curve shifted up from $2 to $4. The supply curve shifted up by the amount of the tax. $4 - $2 = $2 tax per-unit.

How many units were sold at the higher price. Look at the equilibrium of price and quantity for the new S + Tax supply curve.

The tax $2 x 60 units produced = $120 of government revenue.

The area of government revenue also sometimes referred to as the tax wedge.

(ii) What is the after tax price that the seller keeps.

The seller keeps $4 per unit.

(iii) Calculate the producer's surplus after the tax.

The producers surplus is the triangle's area above labelled PS.

Remember area of a triangle is this formula Area = 1/2 b x h or ((b x h) /2)

So, $6-$4 = $2 this is the height

From 0 to 60 = 60 this is the Base

$2 x 60 = $120 ans $120/2 = $60 This is the producers surplus

(C) Is the demand price elastic, inelastic, or unit elastic between the prices of $5 and $6? Explain.

Elasticity Cheat Sheet can be found here.

Price increased from $5 to $6 and the quantity fell from 90 to 60.

So P1 = $5 & P2 = $6 90 = Qd1 & 60 = Qd2

Using the formula above: Remember for PED we use absolute value so ignore the - sign

60-90/90 = -30/ 90 = .3

$6-$5/$5 = 1/5 = .2

.3/.2 = 1.5

and from the cheat sheet

Total Revenue Test = Price Increases and TR will fall if elastic

@ $5 units sold were 90 = TR of 5x90 = $450

@ $6 units sold were 60 = TR of 6x60 = $360

as the Price increases the TR falls, thus the demand is elastic.

(D) Assuming no externalities, how does the tax affect the allocative efficiency. Explain.

Alloactive efficiency for any section except (externalities) is where the market equilibrium occurs.

This happens originally at a price of $5 with 90 units sold.

The indirect tax causes society to have less goods produced than allocatively efficient or socially optimal.

So the tax reduces allocative efficiency which is represented by the Dead Weight Loss (DWL)

No comments:

Post a Comment