Nominal & Real GDP is tested in the multiple choice and in the FRQ's. Know it..

mjmfoodie Video: Real GDP

GDP figures:

US - Bureau of Economic Analysis

Japan - Cabinet Office

Hong Kong - Census & Statistics Department

Nominal GDP: is GDP not adjusted for inflation and is measured with current prices.

Real GDP: is GDP adjusted for inflation.

Inflation: is a sustained increase in the general price level.

Deflation: is a sustained decrease in the general price level.

The problem is in coming up with good figures for GDP we have to be able to use values (prices) for all goods and services (output) produced in that year.

But, if there is a 10% rise in prices (inflation) then GDP will appear to have grown by 10% when in actuality no increase in production happened.

Ex. In 2000 Apples produced (Output)10 and the (price) is $1 each, then GDP = $10

but in 2001 Apples produced (Output) 10 and the (price) is $2 each, then GDP = $20 a doubling of GDP, But there hasn't been an increase in production (output) just an increase in prices (inflation).

So, the fix to allow comparisons over time, GDP has to be measured in real terms, where GDP is adjusted for inflation. We do this by using what is called the GDP deflator.

GDP Deflator or Price Deflator: is like a price index in that it measures price inflation/deflation with respect to a specific base year.

Knowing just this,, lets us do an AP problem:

2005 AP Macroeconomic Exam:

Answer (C) is adjusted for price-level changes using a price index.

So, lets say it again.

Nominal GDP is a measure of output valued at present prices.

Real GDP is a measure of output valued in prices of a base year

Lets find the real GDP using some numbers.

EX.

2014 basket of goods:

What we see is that the Nominal GDP (Output X Current Prices) for 2014 is $52 and in 2015 nominal GDP is $70.

But what if we want to find the Real GDP for 2015,,, we can use 2014 as the base year.

This means we use the Output of 2015 with the Prices of 2014.

So, if we look at the two charts above we can see that overall 2015 had less output but prices increased.

Real GDP for 2015 is $46,,

The GDP Deflator is a price index that can be used to adjust a nations nominal GDP for changes in the Price level.

Formula for finding the GDP Deflator is

Remembering that the base year 2014 always equals 100 since in that year Real GDP = Nominal GDP.

The GDP deflator = Nominal GDP/ Real GDP

So, using the information in the tables above Nominal GDP 2015 is 70/ Real GDP 2015 is 46

Therefore, the deflator is 70/46 = 1.52 or we can say that prices (inflation) have risen by 52%.

*If the deflator had been 95 then prices would have said to have fallen by 5%.

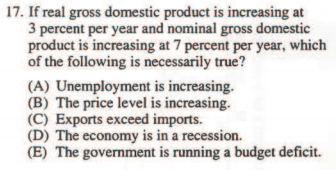

1995 AP Macroeconomics

Answer (B) 7% If Real GDP is Nominal GDP minus inflation then 11-4 = 7%.

Answer (B) If real GDP is nominal minus inflation then 7-3 = 4% inflation, thus rising prices.

2011 B, Question #3 FRQ

A) (i) Nominal GDP for 2010 is simply (output) X (price) for 2010.

So, (8x2.5 = 20) + (10x10 = 100) + (5x5 = 25) = $145

(ii) Real GDP for 2010: is 2010(output) X 2009(prices) or 20 + 60 + 20 = $100

B) This problem always seems to cause some confusion but it's quite simple and once you understand it you on't ever miss another one like this.

1) The increase from one year to the next is 5 (55-50 = 5) & 5 is a 10% increase from the base year. (50/5 = 10%)

2) I would just double the numbers to get a closer understanding to what I'm use to.

So, 50 doubled is 100 and 55 doubled is 110,, therefore the rate of inflation was 10%.

C) If real wages only increase by 3% but inflation increases by 4%. If your real wage is $100 and it went up by 3% to $103 and everything you need to live is paid for out of that $103 dollars, (rent food and clothing). Now, due to inflation, rent, clothing and food will cost you $104 due to the rise in prices(inflation). Your real wage will be lower (worth less) due to inflation. Another way to think about this is that your purchasing power would have shrank due to the inflation.

D) If Sara gets a loan and the expectation is that inflation will be 3% but the inflation rate is actually 4%. Then Sara will have borrowed money at a rate that is less than actual inflation. She will benefit and the bank will not benefit. It (the bank)will be repaid in dollars that can now buy less than when they were loaned.

If you loan $100 to Joe and Joe promises to repay you 101 dollars at the end of the year. You have wanted to buy a Stereo that costs $101 dollars. You will be making a simple interest rate loan of 1%, but at the end of the year inflation has increased by 5% then you will find that the stereo has increased in price to $105 (yea I know the math isn't right,, bear with) and you only get $101 back from Joe. You, my dear friend, have incorrectly predicted the rate of inflation and loaned your money to Joe to cheaply,, you have lost money as the cost of the stereo is further from your grasp than when you initially loaned out the money to Joe. Inflation harms creditors and helps debtors and deflation helps creditors and harms debtors.

2008 B Question #3, FRQ

mjmfoodie Video - Business Cycle