2017 AP Microeconomics FRQ #3

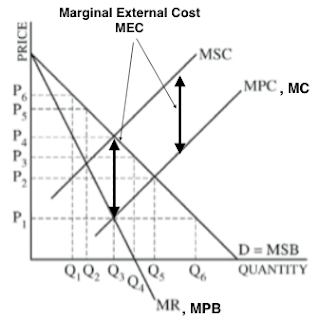

(A) Identify the monopolists.

(i) Profit maximising quantity

(ii) Profit maximising price

Recognise, that the MPC is the MC curve and that the MR = MPB, therefore the Profit Max for this Monopoly is where MR = MC,

Price = P4

Quantity = Q3

Answer

(B) What information in the graph indicates that there is a negative externality?

MSC > MPC = Negative Externality

Answer

(C) Identify the socially optimal quantity.

Social Optimal Quantity is where MSB = MSC

Social Optimal Quantity = Q3

Answer

(D) In the case in which the government imposes a per-unit tax equal to the marginal external cost, identify each of the following.

(i) The dollar value of the tax, using the price labels from the graph

The tax would be equal to the vertical distance between the MSC and MPC. (P4 - P1)

The tax would be equal to the vertical distance between the MSC and MPC. (P4 - P1)

(ii) The profit-maximising quantity associated with the tax.

(E) Given the monopoly facing the negative externality, would the dead-weight loss increase, decrease, or stay the same as a result of imposing the per-unit tax? Explain.