2019 Macro FRQ #1 - Set 2

watch me answer it here

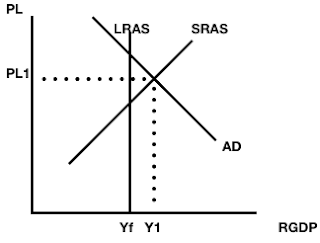

1) Assume Artland is operating above full employment.

(Above full employment = Inflationary scenario)

(ii) If there is no Fiscal or Monetary policy workers will demand higher wages in an inflationary scenario, this shifts the SRAS curve to the left. Higher wages cause business to raise the prices for their goods and services they produce and output returns to the full employment level as demand for these more expensive goods and services falls.

(i) Government spending can decrease

(ii) The unemployment rate will increase - the NRU will not be affected

(iii) Price level in (b) higher or lower than in (c) - (b) has a higher PL

|

| GS decreases & AD shifts left Lowering the PL |

The price level in (c) is lower as Aggregate Demand shifts to the left with the fiscal policy action of a reduction in government spending.

Equilibrium interest rate will decrease as less government spending implies the government isn't borrowing from the loanable funds market. This could have been shown with either an increase in SLF (like I did) or even better a decrease in the demand for loanable funds.

Either is correct and acceptable

2) LRAS curve will shift to the right in the long run as a lower interest rate will increase investment and therefore capital formation causing LR economic growth.