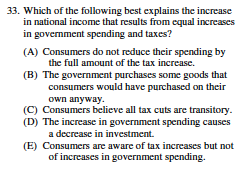

2012 Macro Multiple Choice (Fiscal Policy)

Fiscal Policy Cheat Sheet here.

Answer - (B)

From the cheat sheet.

Answer - (B)

From the cheat sheet

Answer - (C)

From the cheat sheet

Answer - (C)

Understand that ann increase in Government Spending increases consumption which increases Aggregate Demand.

From the AD/AS cheat sheet here.

Answer - (A)

Post that answers this here.

Answer - (C)

If the budget deficit is increasing ,, it means that the government is spending and if the government is spending then the Real Interest Rate (RIR) is increasing.