Inflation (winners & losers) Cheat Sheet

Showing posts with label Inflation. Show all posts

Showing posts with label Inflation. Show all posts

Monday, August 31, 2020

Monday, May 4, 2020

ALL Inflation (Winners & Losers) FRQ's

ALL Inflation (Winners & Losers) FRQ's

2019 AP Macroeconomics Exam (Set 1)

Answer - C

Unanticipated Inflation means that the Price Level has Increased

Creditors who loan money when prices are low and then receive payments when prices are high

are being paid back money that has a lower purchasing power

in essence, the money they lent out could buy more went lent

and can buy less when paid back

Lenders lose, borrowers benefit

Answer - B

Borrowers benefit as when they borrowed the money its purchasing power was high

after inflation

its purchasing power is low

Creditors are worse off as they are paid back dollars that can buy back less

than when they lent the money to the Borrower

Answer - D

Borrowers benefit as when they borrowed the money its purchasing power was high

after inflation

its purchasing power is low

Creditors are worse off as they are paid back dollars that can buy back less

than when they lent the money to the Borrower

Answer - D

Unanticipated inflation benefits borrowers as when prices rise

the money paid back to lenders has less purchasing power

meaning that it can buy less actual stuff than when it was initially loaned.

Wednesday, May 29, 2019

2019 Macro FRQ #2

2019 Macro FRQ #2

Actual inflation is less than the Expected Inflation

As the actual rate of inflation is below the expected rate lenders are better off.

Think of it like this.

Your a banker you need 5% profit and you expect inflation to be 3% this year,

If you just charged 5% at the end of the year the 3% inflation

would have decreased what you gained on the loan to 2%

5% Nominal rate - 3% Inflation rate = 2% Real rate

so,

If you know you need to make 5% and inflation is expected to be 3%

you make the rate of interest on your loan to be 8%.

8% nominal rate - 3% Inflation rate = 5% Real rate

as,

The actual inflation rate was less than the 3% expected rate

lenders would be better off as they make more profit

due to lower actual inflation rates.

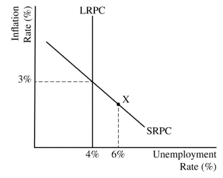

The natural rate of unemployment is not affected by by changes in the price level in the LR.

Remember that the NRU includes frictional and structural

Cyclical is not included into the NRU

Cyclical has to do with recessions and inflationary scenarios

So changes due to AD/AS changes do not effect the NRU

What would affect the LRPC

1) Increased Unemployment Benefits attract citizens to stay unemployed longer shifting the LRPC to the right (Higher Natural Rate of Unemployment)

2) Higher Minimum wage rates - shifts the LRPC to the right

3) Frictional Unemployment increases - LRPC shifts right

4) Structural Unemployment Increases - due to better tech making jobs obsolete. LRPC shifts right.

5) Better ways for unemployed and employers to meet would shift the LRPC left reducing unemployment in the long run.

Monday, April 18, 2016

Subscribe to:

Posts (Atom)