(A) Draw a CLG for CableNow and show each of the following.

(i) The profit maximizing quantity of cable services,

labeled as Q*

(ii) The profit maximizing price, labeled as P*

(iii) The area of economic profit, completely shaded

(iv) The socially optimal level of cable service,

assuming no externalities, labeled as QS

(B) Assume that the

government grants CableNow a lump

sum subsidy of $1 million. Will this policy change CableNow’s profit maximizing

quantity of cable service? Explain. (Explain means Why??)

If the government grants a $1 million lump sum subsidy

CableNow’s quantity produced will not change. Why? A lump-sum subsidy will not

affect CableNow’s marginal costs.

Why?

A lump-sum subsidy is given to a firm whether the firm

produces the good or not. If I own a coffee shop, and the government decides to

give all coffee shop owners a $10,000. Does this increase the amount of coffee

I sell? No. If I don’t sell anymore coffee then I don’t need to hire more

employees. If I don’t hire more employees my marginal cost curve doesn’t shift.

Lump-sum subsidies are often thought of as fixed costs. If your rent (a fixed

cost) decreases would this cause you to employee less people? No. The demand

for your coffee doesn’t change due to a change in fixed costs, so no one will

be hired or fired. But, a decrease in your fixed costs or a lump-sum subsidy

will cause your profits to increase or your losses to decrease.

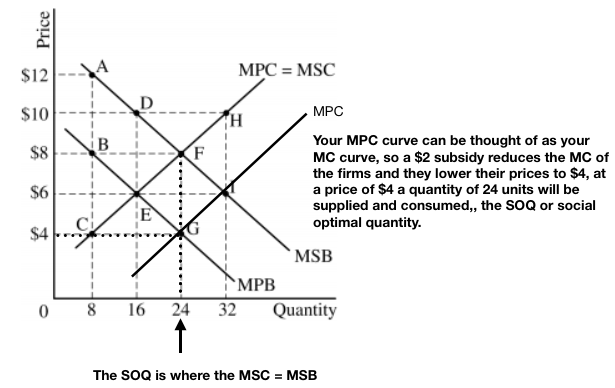

Lets look at a graph using the above information.

In the graph above, notice that the ATC curve decreased as

the lump sum subsidy is granted but the profit maximization point MR = MC

wasn’t affected and therefore quantity didn’t change.

(C) Instead of a

subsidy, the government requires CableNow to produce the quantity at which

CableNow earns zero economic profit. On the graph you drew in part (a), label

this QR.

Obviously, if you don’t know where the point is where zero

economic profit is earned you can’t answer this question.

Know all the points on the graph below. You should be able

to draw a monopoly graph and label each of these possible points. Practice,

practice, practice and then do it again.

If we use the information in the question, and the graph in

the question. Zero economic profit for a monopoly is at the Fair Return or

Break-Even point where

P = ATC = Zero Economic

Profit

(D) At QR, is the firm’s

accounting profit, positive, negative or zero? Explain.

If a firm is

earning zero economic profit it must be covering its accounting profit. Why?

Profit = TR

(total revenue) minus (TC (total costs)

Total Costs

= Explicit + Implicit Costs

Explicit

costs are the costs that you can see; wages, electricity, rent, materials.

Implicit

Cost is the monies that the entrepreneur demands to stay in this industry.

Accounting

Costs are explicit costs, so as long as the firm is covering its explicit costs

it is breaking even according to the accountant. If the firm is covering

(earning) its explicit costs and covering its implicit costs then firm is

making an accounting profit but only earning zero economic profit.

Confusing?

Ok, lets back up and take a little trip.

Charles (the

entrepreneur) has $50,000 and he wants to start a business. Charles can either

invest the $50,000 into a new business or he can put the 50k in the bank where

he will earn interest on his money.

$50,000 x

.01 = $500 a year earned with zero risk and nothing to worry about.

$50,000 x

.05 = $2,500 a year (that is $208 a month guaranteed) enough to pay for Yoga

and Coffee

$50,000 x

.08 = $4000 a year ($333 a month) that will pay your payment for a very nice

car.

So, Charles

has options and the higher the interest rate he can earn the more attractive it

may be to keep the money in the bank.

Lets say the

Bank will pay us 8% on our savings.

But Charles

wants to open a coffee shop.

Our dismal

Economist (David) looks at Charles and says, “ Charles, you must consider the

opportunity cost of any action you take.”

“No I

don’t”, says Charles, as he is naturally cantankerous and politically a

libertarian and hates to be told what to do.

David -

“Well sorry old chap, but economists look at any choices made and evaluate your

next best alternative.”

Charles - “Well,

I have two choices, I can put the money in the bank or I can invest the money

in the coffee shop”. “If I invest in the coffee shop, I will spend the $50,000

and hopefully make 10% a year on my investment.

David - “If you only make 10% or $5,000 a year

then an economist will say that you have really only earned 2% on your

investment because you could have earned 8% of that 10% by keeping your cash in

the bank.” “That 8% is the implicit cost that must be paid to keep you in the

business of supplying coffee to people.” “If, Charles, you invested your

$50,000 in the coffee shop and only made 8%, an economist would have said you

broke-even as you just covered your explicit & implicit costs”. The

accountant would have said that you had earned a profit as your explicit costs

were paid and monies are left over.

Charles –

“So let me get this straight. If I invest my $50,000 in the coffee shop, I pay

all the wages to my employees, the rent, the electricity and I have $2,500 left

over to pay to myself, an economist would say I have incurred an economic loss

but the accountant would say I have made a profit. Who is right?

David – We

both are? The accountant only looks at explicit costs, (rent, electricity,

wages) the economist looks at explicit costs and implicit costs (what could

have been earned by doing the next best alternative). “Really those accountants

are far to optimistic and don’t look at the whole picture.”

The College

Board wants you to understand that as economists we must consider the choices

we didn’t take and consider them as a cost.

Accountant

Loss – Can’t pay your rent, electricity or wages, or some combination.

Accountant Break-Even

or Zero Accountant Profit– Can pay all the bills

Accounting

Profit – Anything amount earned over the explicit costs

Economic

Loss – Earnings below the sum of your explicit and implicit costs

Economic

Break-Even – Earnings cover the explicit costs and implicit costs

Zero

Economic Profit - Earnings cover the explicit costs and implicit costs

Positive Economic

Profit – Earnings more than the explicit & implicit costs

Abnormal

Economic Profit - Earnings more than the explicit & implicit costs

(E) Assume

that a new study reveals that there are external benefits (externalities)

associated with watching TV. Will the socially optimal quantity of cable

service now be larger than, smaller than, or equal to the QS, you

identified in part (A)(iv).

College Board

bastard,, tricky.

If a

positive externality is occurring you can know, that the market is producing to

little of the good/the price is to high. Understand that producing to

little/price is to high is the same thing. The market will produce the quantity

where P = MC/ quantity of QS.

If the

market is producing at QS

but is

producing to little then the Socially Optimal Quantity must be a larger

quantity than QS.

|

| Thanks Nadia, good times in Vancouver. |