Fiscal Policy Expansion & Monetary PolicyExpansion

When Monetary and Fiscal are both expansionary AD (increases) and the IR (no change).

How would this knowledge have helped us with the following question?

2008 AP Micro Exam

Answer - C

To bring the economy out of a recession, AD must shift right.

Expansionary Fiscal & Monetary Policy can be used.

GS increases (expansionary fiscal) & a lowering of the Federal Funds Rate (expansionary monetary)

Of course you need to know that lowering the Fed. Funds Rate increases the MS.

If the FED lowers the Fed. Funds Rate banks can get loans at a lower rate and banks will therefore make more loans and create more money. (Expansionary)

From the Monetary Policy Cheat Sheet (Link)

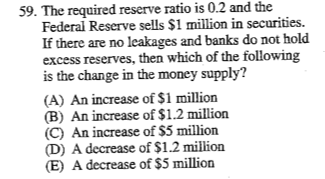

2000 AP Micro

Answer - C - Higher Interest Rates

Fiscal Policy tends to get higher interest rates.

Government Spending Increases and Consumption increases and Investment increases which shifts AD rightward which increases GDP and (Y) incomes and when incomes increases the Demand for Money increases pushing up the Nominal Interest rates and the government borrowing to spend money causes the Demand for loanable funds to increase thus driving up the Real Interest Rate.

or

Fiscal Policy Expansion causes AD to Increases and Interest Rates to Increase.