2019 AP Macro (Set 1) FRQ#3

Watch me answer it here

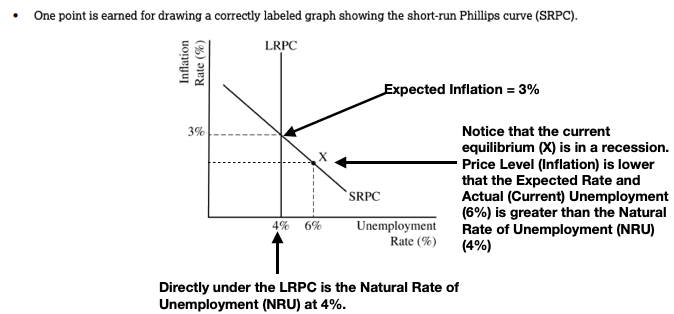

(a.) Draw a CLG of the short run and long run Phillips curve. Label the current short-run equilibrium as Point X and plot the values on the graph.

(b) Is the actual inflation rate greater, less than or equal to the Expected Inflation Rate of 3%.

Less than.

The economy is currencty in a recession and has a lower PL and greater unemployment rate than the Expected inflation rate and NRU.

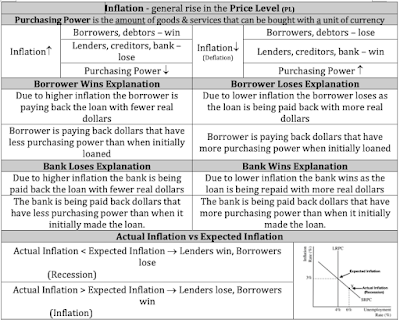

(c) Assume loans were made taking into account the expected rate of inflation at 3%, will lenders (creditors, bankers) be better off, worse off after they realize the actual inflation rate identified in part B? Explain.

Better off as the actual inflation rate is less than the expected rate.

Bankers must take into account the inflation rate. Why?

Suppose you make a loan to someone with an interest rate of 3%. This is the nominal rate you have charged them and actual inflation turns out to be 3%.

Stupid, Stupid, Stupid

{{Nominal - INflation = Real}}

If you charge then 3% and the Inflation rate is 3% then you have made 0 real dollars

Remember inflation implies that the price of everything increased by 3%,

you made 3% on your loan but the price of everything increased by 3%.

If you had charges 5% and the inflation rate was 3% then you would have made 2% on your money.

If you charged 3% and the inflation rate was 1%, then you earned 2% on your loan and this is what we have in the problem above. The actual rate is less than the expected rate of 3% and therefore the banker wins.

(d) Based on the relationshipbetween the actual and the expected, what will happen to the natural rate of unemployment in the long-run?

What we know is that in the long-run we always return to the LR rate of unemployment at 4%.

The only time the college board has tested the NRU actually changing was 1 year when they had unemployment benefits increasing. This caused more people to choose to stay unemployed and therefore the NRU increased as the LRPC shifted right.

In the situation above (in the long-run) wages would fall, input prices would fall and the SRPC would shift leftward taking us back to fullemployment at a lower price level.

but the NRU would remain unaffected.

(Think Classical view)