2023 AP Macroeconomics FRQ Set 1 #2

(From the Ample Reserves Cheat Sheet)

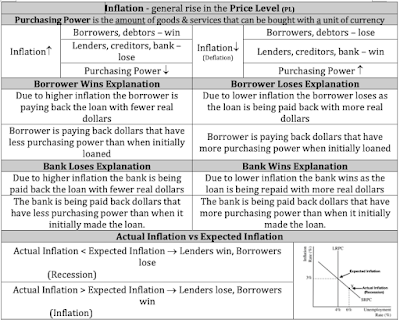

This implies that the economy is in an inflationary gap.

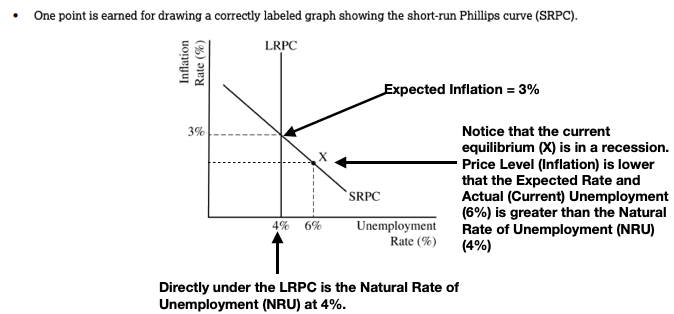

Look at this graph from the Phillips curve cheat sheet.

Notice that expected inflation is the same as full employment

If the inflation rate is greater than expected inflation we must have an inflationary gap.

A) Draw a correctly labeled graph (CLG) of the short run and long run Phillips curve. Label the current short run equilibrium point as X.

B) The banking system in Norlandia has ample reserves. Identify a specific monetary policy action that the central bank of Norlandia would take to bring the inflation rate closer to the expected rate of inflation.

Ample Reserves used to decrease the Price Level (PL) Inflationwould need to be contractionary.

Contractionary Monetary Policy with Ample Reserves is

Increasing the Administered Interest Rate (AIR)

or

Increasing the Interest on Reserve Balances (IORB)

A specific monetary policy to lower inflation toward the expected inflation rate

is to increase the (AIR) Administered Interest Rate

C) Based solely on the effect of the monetary policy action identified in part (b) on interest rates in Norlandia, will there be an increase, decrease or no change in the flow of international capital into Norlandia? Explain.

We should understand that foreign capital (money) is always looking for higher rates of return.

Higher interest rates in Norlandia will attract more/increase foreign capital as these investors want to put their money into Norlandia to make higher profits on the higher interest rates paid in Norlandia banks.

(we are speaking about people putting their money into Norlandia banks

and earning a higher interest rate on their savings/capital)

D) Based on the answer in part (c), what will happen to international value of Norlandia's currency? Explain.

For foreign capital to flow into Norlandia's banks and get the higher interest rates it first must be converted into Norlandia dollars as Norlandia banks only accept Norlandian currency.

If people are buying more Norlandian currency

then the supply of Norlandian currency in the FOREX is decreasing/shifting leftward

this will cause the value of Norlandian currency to appreciate.