AP views on Interest Rate Changes & Investment,

Growth in the SR & LR - FRQs

So, I've noticed that there are quite a few questions asking about growth, investment in the short-run and the long-run and I wanted to clarify a few points in my own head.

You must understand what causes interest rates to increase and decrease. This means that fiscal policy actions (expansionary & contractionary) and monetary policy actions. These also might be given in combo questions as in the Government spending increases and at the same time the FED sells bonds. What would the effect be to the interest rate and how would this affect the growth rate.

Fiscal Policy Cheat Sheet here.

Monetary Policy Cheat Sheet here.

Combo (Monetary & Fiscal) post here.

Summation of FRQ's

Investment

2016 - Monetary expansion (buying bonds) = NIR decreases = Investment increase in the short-run

2013 - Personal Savings Increase = RIR decrease = Investment increases

2010 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2008 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2005 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2005B - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

Growth

2015 - Fiscal expansion (taxes decrease) = LRAS - Growth decreases in the long-run (crowding out)

2014 - Fiscal expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2013 - Savings Increases = RIR decrease = Investment increases - Short-Run Growth increases

2010 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2008 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2005 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2003B - Fiscal Expansion (gov't spending inc.) = Growth decrease/long run (slows capital formation)

Understanding

*Fiscal Exp. = Investment, SR & LR growth rate decreased, Why? - (slows capital formation)

*Fiscal Cont. = Investment, SR & LR growth rate increased, Why? - (more capital formation)

*Monetary Exp. = Investment, SR & LR growth rate increased, Why? - (more capital formation)

*Monetary Cont. = Investment, SR & LR growth rate decreased, Why? - (slows capital formation)

Understand that if society chooses to produce more capital goods instead of consumer goods as seen on the PPC, (capital goods = investment), this represents more growth.

Long-run growth is driven by productivity and this is promoted with more capital goods.

Here is a post on **Growth, PPC & Productivity and includes valuable multiple choice questions.

Notice that the Nominal & Real rates of interest always point in the same direction.

(If you can figure out one then you know what the other is doing)

So, Investment, Growth, Long-Run & Short-Run

Understand that Investment decreases when Interest Rates (Ir) increase and Investment increases when Ir. fall. This makes sense as businesses tend to want lower rates on their loans. Lower interest rates mean higher potential profits.

The volume of investment made today will, in turn, determine how much capital we have tomorrow-and thus influence the size of our potential GDP.

A larger national debt may lead a nation to bequeath less physical capital to future generations. If they inherit less plant and equipment, these generations will be burdened by a smaller productive capacity-a lower potential GOP. In other words, large deficits may retard economic growth. By the same logic, budget surpluses can stimulate capital formation and economic growth.

Let us look at some problems involving growth, investment and a short or long-run view.

I will only answer the questions that pertain to this issue.

2016 AP Macro FRQ #1

Specifically, questions (C), (D) and (E) are where we are looking.

(C) If the Federal Reserve wants to lower unemployment, what expansionary open-market policy should it use?

If the FED wants to lower (make less) unemployment then the FED needs to increase the money supply (buy bonds) which will lower the nominal interest rate causing investment to increase.

(D) How will the OMO effect the following:

(i) Federal Funds rate

(ii) Real Interest Rate in the Short-Run

So, clearly with an expansionary monetary policy (buying bonds) interest rates will fall stimulating investment in plant and equipment in the short-run.

2015 AP Macro FRQ #1

(E) Assume the government lowers income taxes (fiscal exp.) to eliminate a recessionary gap. Will each of the following increase, decrease, or stay the same.

(i) Aggregate Demand. Explain. (Not really interested in this part)

(ii) Long-Run Aggregate Supply. Explain (THIS!)

Obviously the point is to be able to explain either point you choose. I choose that LRAS (Growth) will decrease in the long run as lowering taxes will lead to a crowding out of investment. Lowering taxes without lowering overall government expenditures implies the money will just have to be borrowed.

Confusing , Yes?

2014 AP Macro FRQ #1

(D) Using a CLG of the loanable funds market, show the effect of a $100b increase in government spending on the real interest rate.

(E) Based on the real interest rate change in (D), what is the effect on the long-run economic growth rate? Explain.

2013 AP Macro FRQ #1

(B) Assume that personal savings in the US increases Using a CLG of the loanable funds market, show the impact of the increase in personal savings on the real interest rate.

(C) Based on the real interest rate change in (B)

(i) will interest rate expenditures increase, decrease or remain the same.

(ii) What will happen to the rate of economic growth? Explain.

2010 AP Macro FRQ #1

(D) In order to finance the increase in government spending on national defense from part (B), the government borrows funds from the public. Using a CLG of the loanable funds market, show the effect of the government's borrowing on the real interest rate.

(E) Given the change in the real interest rate in part (D), what is the impact on each of the following?

(i) Investment

(ii) Economic Growth Rate. Explain

2008 AP Macro FRQ #1

(D) Using a CLG of the loanable funds market, show the impact of the increased government spending on the real interest rate in the economy.

(E) How will the real interest rate change in part (D), affect the growth rate of the US economy? Explain.

2005 AP Macro FRQ #2

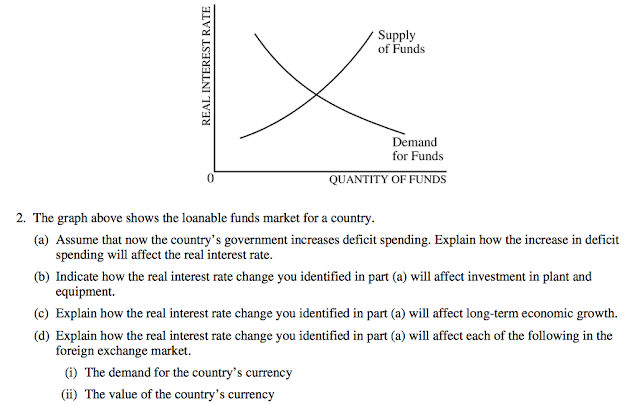

(A) Assume that now the country's government increases deficit spending (borrowing). Explain how the deficit spending will affect the real interest rate.

(B) Indicate how the real interest rate change you identified in (A) will affect investment in plant and equipment.

(C) Explain how the real interest rate change will affect long-run economic growth.

2005B AP Macro FRQ #3

(A) Using a CLG of the loanable funds market, show the effect of an increase in A's budget deficit (government spending) on the real interest rate.

(B) Given your answer in (A), what is the effect on the business investment in A?

2003B AP Macro FRQ #1

(C) Using a CLG of the loanable funds market, show the effects of the increase in deficit spending on the real interest rate.

(F) Given the result in th loanable funds market discussed in (C), explain how the government deficit spending would influence long-run growth.

Summation:

Investment

2016 - Monetary expansion (buying bonds) = NIR decreases = Investment increase in the short-run

2013 - Personal Savings Increase = RIR decrease = Investment increases

2010 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2008 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2005 - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

2005B - Fiscal Expansion (Gov't spending) = RIR increases = Investment decreases

Growth

2015 - Fiscal expansion (taxes decrease) = LRAS - Growth decreases in the long-run (crowding out)

2014 - Fiscal expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2013 - Savings Increases = RIR decrease = Investment increases - Short-Run Growth increases

2010 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2008 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2005 - Fiscal Expansion (gov't spending inc.) = Growth rate decrease (slows capital formation)

2003B - Fiscal Expansion (gov't spending inc.) = Growth decrease/long run (slows capital formation)

No comments:

Post a Comment